Factors to Consider When You’re Moving House

The seemingly never ending process of moving house is something that most of us will experience at least once in our lives. A test of anyone´s will power, the process of buying and selling alone is enough to make most people re-consider the idea until absolutely necessary. Then comes the physical move and all that entails. Once the logistics are taken care of and your possessions, furniture and family members are safely installed in your new home, there is the small matter of sorting out utilities.

Utilities

One thing to think about today is the state of the energy market. While not something you automatically associate with moving house, it is more of a factor than a few years ago. Again, sadly this is because of rocketing prices for Gas and Electricity. At the moment, if you move home and have to sign up with a new provider at your next property, there is a high chance that your new deal will be significantly more expensive than the one you left behind. This would happen if you agreed a fixed price deal before October 2021 and then signed on for a tariff at 2022 prices. Moving just now may be tempting, getting out of or into the city, relocating to somewhere with more green space or a nicer living room, but unless your needs are urgent, it’s worth considering the value of what you are paying for, versus what you are selling.

Happily, there are still a wealth of options for comparing the market and getting a competitive deal on your energy. Companies like Papernest will recommend, compare and give advice to all home movers seeking a new fixed or variable plan. This could potentially save you hassle further into the future and with the energy market poised to get more expensive, save you money.

In addition, there is always the option of reducing utility costs by creating a more energy efficient and sustainable home. Various ways of achieving this include fitting insulation, double or triple glazing, draught proofing, energy efficient fittings, or even generating your own energy from renewable sources. See this article for more information on sustainable property development.

Selling

These days more than ever, the housing market is more like asset management than simply choosing a new place to live. Unless your reasons for leaving are quite urgent, many homeowners would do well to monitor the market and look into increasing the value of their home before leaving. There is also the possibility of renting out your home. In terms of adding value, a renovation is one of the most reliable methods of adding anywhere from £5k-25k to the asking price, although in some cases this can be even higher. As we slowly leave behind the worst of the pandemic that forced people to work from home, many are considering more carefully the conditions in which they choose to live.

Buying

As the UK Government hopes for an economic recovery, the painful truth is that success will hinge on the performance of the housing market, still heavily linked with UK prosperity. There is also a high level of demand caused by the pandemic´s effect of holding still the patterns of home movers and renters that exist in the UK. As the market restarts properly, the market is soaring in price and those selling are getting a lot more for their money than they perhaps should do. So, buyers beware of inflated prices and values and be vigilant over valuations of properties that were not so expensive, not so long ago.

Stamp Duty

Stamp duty can add a considerable cost when buying a house. Check the applicable percentage rate when calculating what you can afford to offer for the property, to avoid a nasty surprise later.

Council Tax Bands

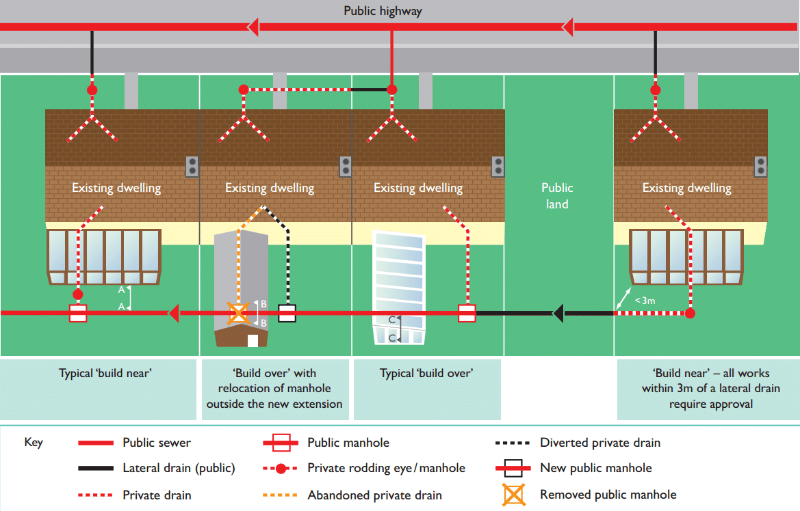

Find out if what extensions or building works have been completed by the former owner/s. If the seller has had improvements made, then the change of ownership can trigger an increase in the council tax due on it. This is because councils take note of home enlargements but generally delay implementing a tax band increase until it is sold on. The new tax band could be one or more brackets above what is quoted on the estate agent’s brochure.

Planning

Whilst many prospective buyers may dream of discovering their dream house, in the right location, within the right price bracket, already on the market, this is rarely a reality; more often than not, buyers plan to make changes to the property once they have purchased it, in order to better suit their needs. Therefore, the feasibility of these potential changes to an existing property is a crucial factor to consider when buying. For example, whilst you may think that adding an extension to the rear of a potential new property will accommodate your lifestyle perfectly, it cannot be taken for granted that such an extension will be given planning permission – in which case, that particular property may not be such a good fit for your needs. In order to avoid being unable to carry out your intended plans on your property once you have bought it, it is always a good idea to assess the likelihood of planned changes meeting planning approval prior to going ahead with your purchase. For more information on this topic, see this article.